By David A. Belforte

These are unsettled times for global manufacturing. Setting aside the normal up and down cycles of manufacturing — a number of global factors — ranging from Brexit concerns, to economic problems in China, turmoil in the mid-East and a new administration in Washington give cause for concern about economic growth prospects.

Trumping (pardon the pun) these concerns is the current status of industrial laser activity in the global manufacturing sector, that seemingly ignoring external effects, are enjoying another growth year (revenues up by more than 10 percent) led by strong double-digit sales of high-power fiber lasers, a surge in excimer laser revenues led by excimer laser silicon of displays and significant rises in uses for ultra-fast pulse lasers.

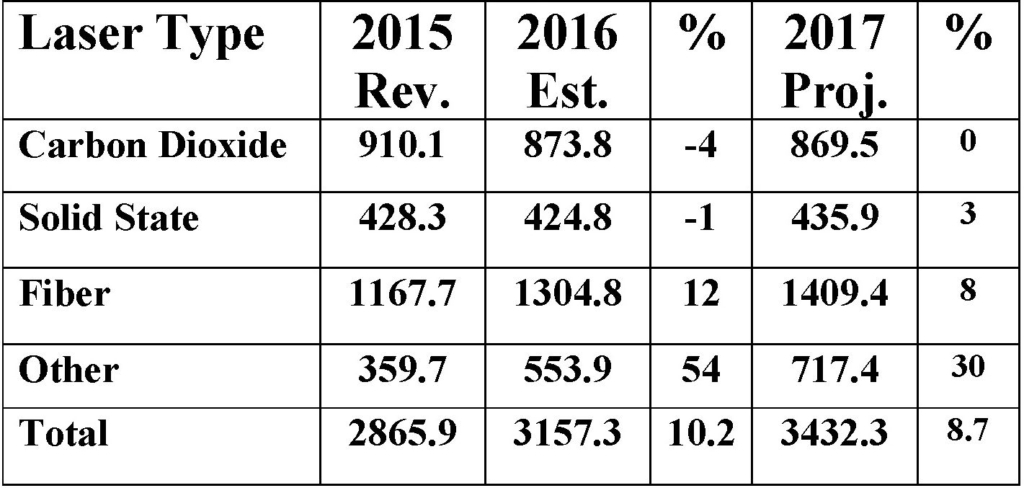

Fiber lasers at the kilowatt for metal cutting and joining operations, continue to outpace other laser types, representing 41 percent of the total industrial laser revenues in 2016. Fibers’ 12 percent increase came, in part, at the expense of CO2 (-4 percent) and solid-state (-1 percent) lasers. On a percentage basis direct-diode and excimer lasers in our ‘Other’ category enjoyed the largest annual revenue gain (54 percent) in recent years. These lasers have been recording strong gains based on their limited base numbers in several of our last reports. But one application, excimer laser annealing of silicon (FPE) used in mobile phone displays caused one company, Coherent, Inc., to book multiple orders worth several hundred million dollars for system’s to be delivered into 2018.

The overall revenue growth for industrial lasers in 2016, estimated at slightly more than 10 percent, would in reality be more like 4 percent if we deduct the 2016 FPE revenues; leading to fiber lasers inexorable drive to 50 percent of total laser sales. US based IPG Photonics will have a record 2016 as their revenues from fiber lasers for nine months passed $726 million and, at the high end of guidance for the 4th quarter, could be pushing the $1 billion mark (admittedly not all revenues are generated by laser sales).

Joining IPG Photonics near the billion dollar level is Coherent, Inc., whose fiscal year closed in October at a bit more than $857 million, but strong excimer sales at the end of the year should assist them breaking the barrier (not all revenues are industrial laser related). Certainly after their merger with Rofin-Sinar they could be over the $1.5 billion.

Sitting atop the ‘billionaires’ club is industry giant Trumpf Group whose 2015/2016 approached the $2.8 billion mark, of this, laser technology (including some laser systems) alone topped a billion dollars.

The aforementioned is not intended to belittle a fine group of laser companies who also make up the industrial laser market, but it is these Big Three that dominate the news.

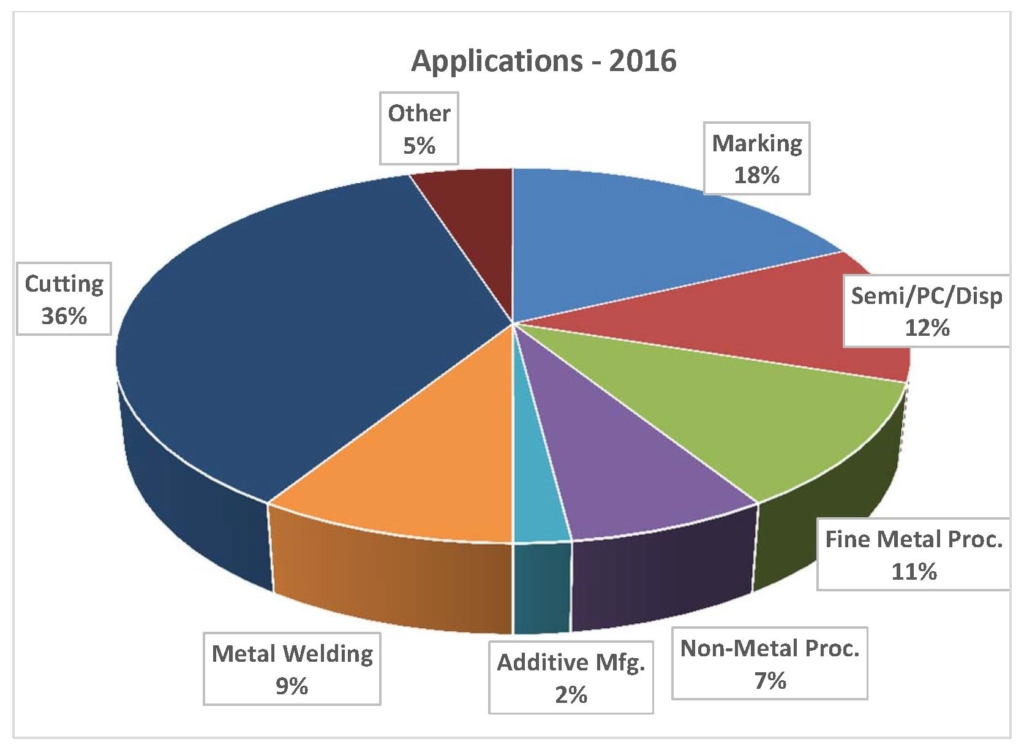

As stated earlier, and shown in the table above, 2016 was another growth year for industrial lasers. In an otherwise moribund global capital equipment market, laser system sales grew in industry sectors that continue to show strength: automotive, aerospace, energy, electronics and communications (smart phones). We divide lasers into three major categories: the first is marking, including engraving, that contributes about 18 percent of all laser revenues and, because this is the most global of all laser markets, traditionally has shown solid growth in all non-recessionary years, continues the trend with a 3.9 percent growth dominated by fiber lasers at 49 percent of the total.

The second category is Micro, which includes all applications using lasers with < 500 W of power, which in 2016 climbed to 35 percent of the total laser market thanks to a 10.2 percent growth in the sector that included display applications requiring excimer lasers. Ultra-fast pulse (UFP) lasers are gaining adherents in the Micro sector and this technology will shore up otherwise decreasing solid-state laser revenues.

The laser category Macro, that includes laser processes requiring more than 500 W of power, is the largest, at 47 percent, of all industrial laser revenues, thanks to fiber lasers which make up 44 percent of all Macro revenues. In 2016, CO2 lasers bore the brunt of fiber laser’s penetration into their largest revenue market, sheet metal cutting, resulting in a 4 percent decline in revenues with an almost 11 percent increase in high-power fiber laser sales. Additive manufacturing demand for more productivity has caused a spurt in higher power CO2 laser demand at the kilowatt level which is factored into the Other category.

Applications

Cutting as an industrial laser application is the most important on two levels: revenues generated and as a user of high-power fiber lasers. Globally over 70 integrators supply flat sheet cutters for metal fabricating. This sector is key among both industrialized and emerging nation economies, therefore its growth prospects are closely tied to a nations GDP. In 2016 global economic growth dipped below 2015 and is expected to expand only slightly in 2017. Thus sheet metal cutting, a key economy indicator, had an off year in terms of growth, with a concomitant softness in high power laser growth to 3.5 percent, which was irregular around the globe.

Fortuitously, expansion in global demand for laser welding (3.4 percent) led by the auto industry and boosted by pipeline and downhole oil pipe welding made up the difference.

Non-metal processing applications in paper converting and fiber reinforced polymers combined with fine metal processing (replacing mechanical fine blanking) to add 5 percent to total market growth. Additive manufacturing, more specifically laser metal deposition, grew 22.1 percent in 2016 spurred by acceptance in the aviation engine industry, with some growth in higher-power lasers accounted for in the Macro category. Both intermediate and high power CO2 and fiber lasers are used depending on material selection. In 2016, other less advanced user industries moved more slowly on acceptance as realization of secondary post-LAM processing required ROI readjustment.

The Future

Economic projections for manufacturing in 2017 are a repeat of 2016 with pockets of sluggishness (East Asia, South America and Eastern Europe) continuing. For industrial lasers we are expecting a return to recent annual trends in total market growth with a projected 8.7 percent revenue growth. Marking laser sales are expected to show a decline as unit prices continue to erode mainly in the Asian markets.

Micro laser sales will be a bright light in the revenue picture as FPE laser shipments continue and non-metal processing grows in importance. This category will grow to 38 percent of total revenues.

Sales of laser in the Macro category level off to 47 percent of 2017 total revenues, with continued decreasing revenues in the CO2 segment and a shift into high single digit growth in the fiber laser segment with a more typical 8 percent projection. Solid-state laser (buoyed by UFP lasers) should return to the plus side with a 3 percent growth for 2017. An anticipated shift to high-power direct diodes will pump up the Other category.

David Belforte is Editor-in-Chief of Industrial Laser Solutions.